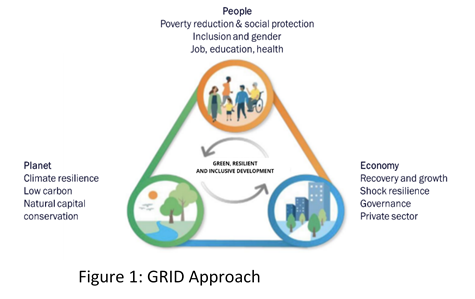

On 23rd September 2021, "Kathmandu Declaration" an astounding day for Nepal to approach development differently and not as business as usual through GRID. A commitment from Government of Nepal and 17 Development Partners (DP) has agreed upon the joint development and delivery of a GRID Strategic Action Plan (SAP). It outline a path of sustained and equitable growth, while simultaneously meeting environmental and climate resilience goals and restoring momentum on the Sustainable development Goals. .

For GRID approach to implement, it will require an investment at scale in human, physical, natural and social capital and systems from domestic and international public and private sources. The key transitional factors of economy i.e. policy, institution, information, incentives which are the driving elements should be favorable to harness the investments.

Net worth of 25 Billion dollar has been estimated to achieve green growth targets portrayed in Nationally determined contribution (NDC) of Nepal. Financial dependency of government will not be sufficient. A strong private sector involvement will be needed. The scale of investment needed far exceeds the possibilities of the public sector. Reforms are needed to remove constraints to private investment in appropriate sectors and technologies. Thus, at the country level, a strong partnership and dialogue between the public and private sector is urgently needed. And further developing and implementing green financial sector regulation, such as reporting standards and green taxonomies, can help harness investors’ increasing appetite for sustainable investments, which offer both measurable impacts on the environment and society.

However, sustainable and substantial flows of finance across borders will need to supplement domestic efforts. Multilateral development banks (MDBs) and Development Finance Institutions (DFIs) must focus on catalytic and transformational investments in priority areas to develop green, inclusive and resilient project pipelines that support economic growth, and job and income generation. On this front, MDBs can help lower risks for private capital through guarantees and blended finance. Private sector dynamism and innovative financing will need to power the recovery and to create economic growth and employment through investment and innovation. Public-private partnerships and key upstream policy reforms can spur private investment (including FDI), support viable firms through restructuring, and enable the financial system to support a robust recovery through the resolution of non-performing loans.

But at the end of the day the most effective way to attract private capital is through policies that correct distortions that render environmental destruction profitable.